Page 45 - annualreport2020

P. 45

AFRICAN DAWN ANNUAL REPORT 2020

Accounting Policies continued

1.7 Income taxes

Tax expense

The tax expense for the period comprises current and deferred tax. Tax is recognised in the income statement.

Current taxation

Current taxation is the expected tax payable on the taxable income for the year, using taxation rates enacted or substantively enacted at the

reporting date, and any adjustment to taxation payable in respect of previous years (prior-period tax paid).

Deferred tax

Deferred taxation is recognised in respect of temporary differences between the carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for taxation purposes.

Deferred taxation is recognised in profit or loss for the period, except to the extent that it relates to a transaction that is recognised directly in

equity or in other comprehensive income, or a business combination that is accounted for as an acquisition.

Deferred taxation assets are recognised to the extent that it is probable that future taxable income will be available against which the unutilised

taxation losses and deductible temporary differences can be used. Deferred taxation assets are reviewed at each reporting date and are reduced to

the extent that it is no longer probable that the related taxation benefits will be realised.

1.8 Property, plant and equipment

Property, plant and equipment is carried at historical cost less accumulated depreciation and any accumulated impairment losses.

An item of property, plant and equipment is recognised as an asset when it is probable that future economic benefits associated with the item will

flow to the company, and the cost of the item can be measured reliably.

Depreciation is recognised so as to write off the cost of assets over their estimated useful lives, to their residual values. The straight-line method is

used and the estimated useful lives are as follows:

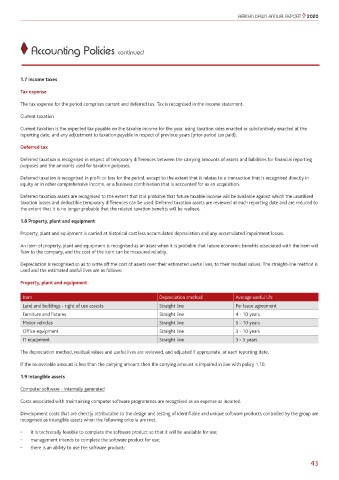

Property, plant and equipment

Item Depreciation method Average useful life

Land and buildings - right of use assests Straight line Per lease agreement

Furniture and fixtures Straight line 4 - 10 years

Motor vehicles Straight line 5 - 10 years

Office equipment Straight line 3 - 10 years

IT equipment Straight line 3 - 5 years

The depreciation method, residual values and useful lives are reviewed, and adjusted if appropriate, at each reporting date.

If the recoverable amount is less than the carrying amount then the carrying amount is impaired in line with policy 1.10.

1.9 Intangible assets

Computer software - internally generated

Costs associated with maintaining computer software programmes are recognised as an expense as incurred.

Development costs that are directly attributable to the design and testing of identifiable and unique software products controlled by the group are

recognised as intangible assets when the following criteria are met.

• it is technically feasible to complete the software product so that it will be available for use;

• management intends to complete the software product for use;

• there is an ability to use the software product;

43