Page 43 - annualreport2020

P. 43

AFRICAN DAWN ANNUAL REPORT 2020

Accounting Policies continued

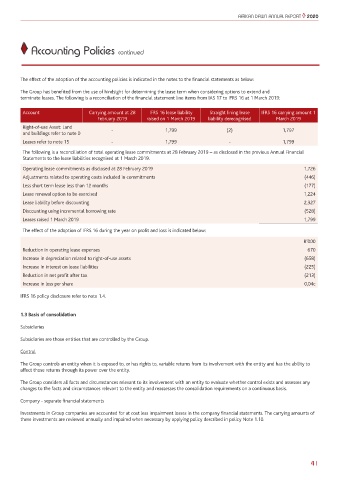

The effect of the adoption of the accounting policies is indicated in the notes to the financial statements as below:

The Group has benefited from the use of hindsight for determining the lease term when considering options to extend and

terminate leases. The following is a reconciliation of the financial statement line items from IAS 17 to IFRS 16 at 1 March 2019:

Account Carrying amount at 28 IFRS 16 lease liability Straight lining lease IFRS 16 carrying amount 1

February 2019 raised on 1 March 2019 liability derecognised March 2019

Right-of-use Asset: Land

and buildings refer to note 0 - 1,799 (2) 1,797

Leases refer to note 15 - 1,799 - 1,799

The following is a reconciliation of total operating lease commitments at 28 February 2019 – as disclosed in the previous Annual Financial

Statements to the lease liabilities recognised at 1 March 2019.

Operating lease commitments as disclosed at 28 February 2019 1,726

Adjustments related to operating costs included in commitments (446)

Less short term lease less than 12 months (177)

Lease renewal option to be exercised 1,224

Lease liability before discounting 2,327

Discounting using incremental borrowing rate (528)

Leases raised 1 March 2019 1,799

The effect of the adoption of IFRS 16 during the year on profit and loss is indicated below:

R’000

Reduction in operating lease expenses 670

Increase in depreciation related to right-of-use assets (658)

Increase in interest on lease liabilities (225)

Reduction in net profit after tax (213)

Increase in loss per share 0,04c

IFRS 16 policy disclosure refer to note 1.4.

1.3 Basis of consolidation

Subsidiaries

Subsidiaries are those entities that are controlled by the Group.

Control

The Group controls an entity when it is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to

affect those returns through its power over the entity.

The Group considers all facts and circumstances relevant to its involvement with an entity to evaluate whether control exists and assesses any

changes to the facts and circumstances relevant to the entity and reassesses the consolidation requirements on a continuous basis.

Company - separate financial statements

Investments in Group companies are accounted for at cost less impairment losses in the company financial statements. The carrying amounts of

these investments are reviewed annually and impaired when necessary by applying policy described in policy Note 1.10.

41